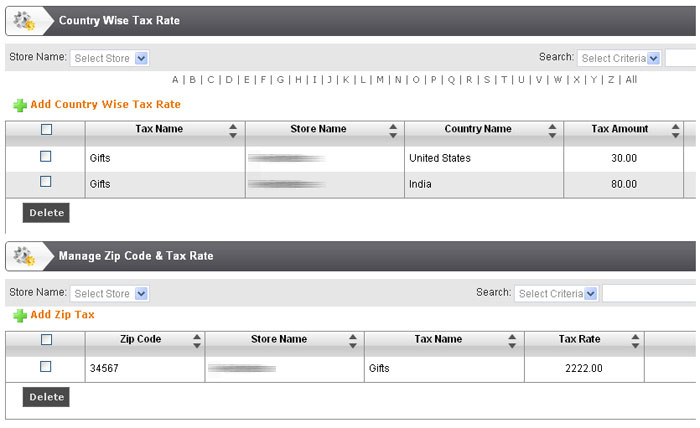

Tax Management is also an important section for e-commerce.

The tax setup is based on:

- From where a customer purchases the product. Tax rules vary based on different cities, states, and countries.

- Type of product that a customer purchases. For example, many places don't tax clothing purchases and, some places tax only some kinds of clothing. This means that you must be able to apply different tax rates to different kinds of products.